Debt & Mortgage Elimination

Reshape How Your Money Moves

Pay Off All Your Debt, Including Your Mortgage, in 1/3 the Time

No refinancing. No extra income. No lifestyle changes.

Your income already has the power to set you free, we’ll show you how to redirect it. This first stage of the Debt to Wealth Process focuses entirely on eliminating debt, helping you collapse interest and free up cash flow using the income you already have.

Your income is like a river — steady, powerful, and full of potential. It should feed your land, grow your crops, and bring peace to your family. But right now, it’s doing exactly what it was designed to do — feed the bank.

The system was built by them, for them, so their fields always stay green while yours run dry. They’ve mastered the rhythm of money. You just haven’t been shown how to control it yet.

This process is about taking that control back. It’s not about cutting coffee, skipping vacations, or depriving yourself. It’s about precision — learning how your money moves and adjusting the rhythm so every dollar does more.

When your cash flow changes, your future changes.

The Problem — Why Debt Feels Normal

Across Pierce County; from Gig Harbor through Tacoma, Lakewood to Puyallup, and throughout the U.S., families are working hard, earning steady incomes, yet feeling like they’re standing still.

It’s not your fault — it’s the bank’s design. Their system was built to make sure your money flows to them first and stays there as long as possible.

We teach homeowners, families, and professionals how to use their existing income to eliminate debt faster — including their mortgage — build stability, and create lasting freedom.

The Flow That Keeps You Stuck and the One That Sets You Free

We teach you to bank like a bank — with precision, not pressure. No refinancing, no consolidation, no gimmicks — just structure, math, and momentum.

Quick Facts

- Works without refinancing

- Includes mortgage, auto, credit card, and student loan debt

- No lifestyle changes required

- 100% virtual nationwide

- Discovery & Savings Analysis are free

- Most families become debt-free in 1/3 the time

- Average client saves 20+ years of payments

- You stay in full control of your accounts

Old Flow vs. New Flow

Old Cash Flow (Bank’s System)

You get paid → The bank collects first → You get what’s left → Repeat

- Feeds the bank’s future

- 30 years of payments

- You work harder

New Cash Flow (Designed for You)

You get paid → Your income moves with intention → Debt shrinks → Cash flow expands → Freedom accelerates

- Nourishes your future

- Debt-free in about

1/3 the time

- Your money works smarter

The difference isn’t income — it’s TIMING, DIRECTION, AND STRUCTURE.

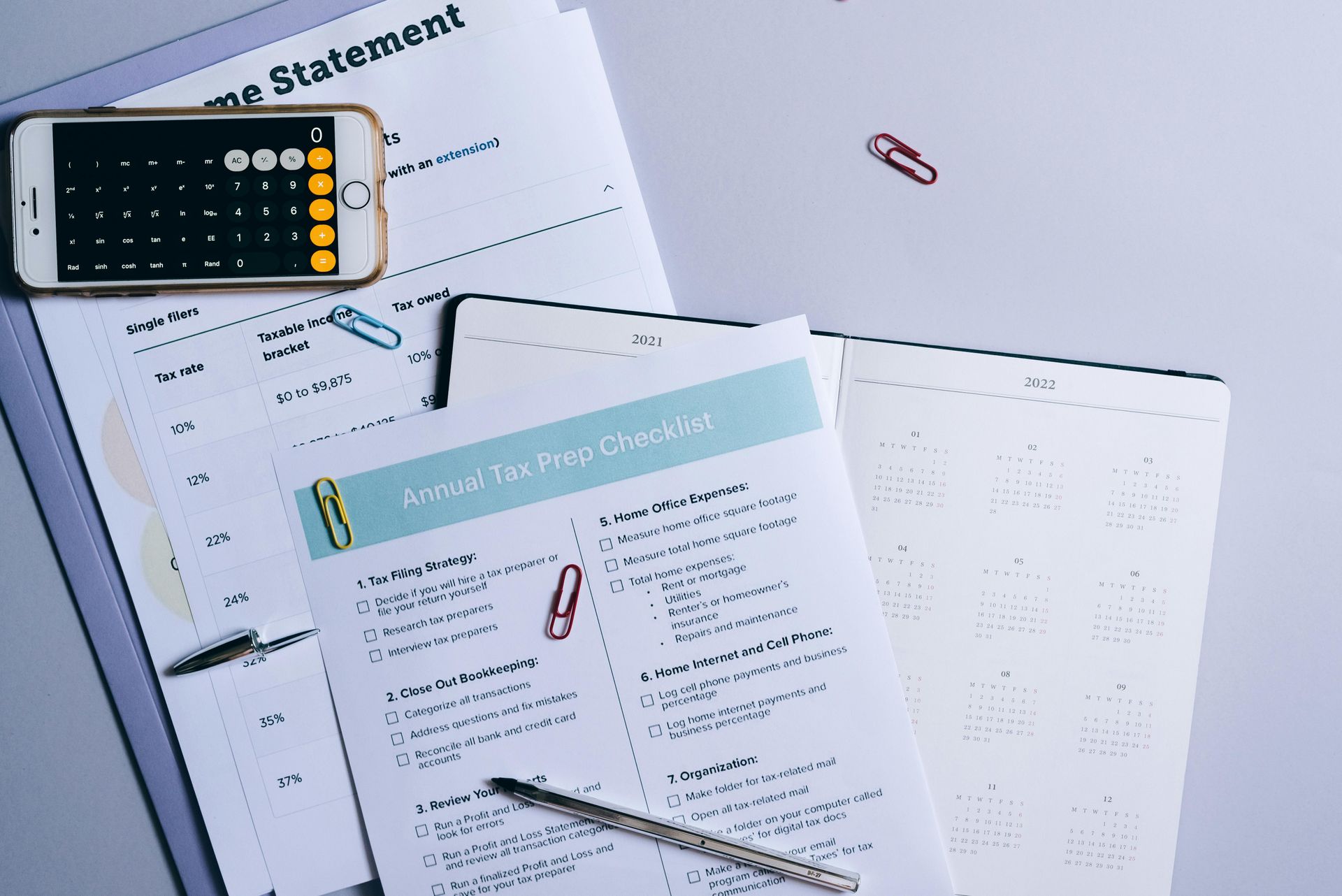

The 3 Steps to Redesigning Your Flow

The debt elimination process follows the same proven structure that helps you redirect your income, collapse interest, and regain control of your cash flow.

Step 3: Implementation & Coaching

No new loans. No refinancing. No lifestyle cuts. It runs quietly in the background.

Once it’s in motion, maintaining your plan takes about 20 minutes a month.

Why It Works

- You don’t earn more: you just redirect your income smarter.

- You don’t refinance: you simply change your structure and cash flow.

- You don’t lose control: you keep all your accounts.

- You save time: often 20 years or more off your mortgage and debt timeline.

- You save money: by cutting the bank’s profit out of your future.

It’s not magic. It’s math; guided by timing, direction, and structure.

Real Families. Real Freedom.

“We thought we’d have this mortgage forever. Now we’re on track to be debt-free before our kids finish high school.” — Megan & Luis, Puyallup, WA

“We live in Georgia and found this program online. I never thought this would work virtually, but the math doesn’t care about zip codes. Our debt timeline dropped by 18 years.” — Andrea R., Atlanta, GA

Results From the Debt to Wealth Process

| Household | Time to Pay Off Debt (Reduced From) | Interest Avoided | Wealth Built During the Same Time | Monthly Income Created Afterward | Total Benefit |

|---|---|---|---|---|---|

| Late Starter | 27.8 yrs → 10.2 yrs | $500,925 | $1,602,446 | $7,803/mo | $5,437,355 |

| Mid-Career Catch-Up | 28.2 yrs → 12.1 yrs | $211,457 | $1,030,303 | $8,866/mo | $4,735,000 |

| Independent Professional | 29.3 yrs → 12.6 yrs | $145,575 | $800,435 | $6,424/mo | $2,365,100 |

| Early Family with Student Loans | 35.8 yrs → 12 yrs | $95,491 | $631,554 | $5,166/mo | $1,922,586 |

| Growing Family | 27.6 yrs → 10.3 yrs | $133,843 | $308,730 | $3,738/mo | $1,470,000 |

Final Thought

For families across Gig Harbor, Tacoma, Lakewood, and Puyallup, and throughout Pierce County - across the U.S., this is where freedom begins.

As your money starts moving faster through the process, every dollar begins doing two jobs at once, reducing debt while opening the path toward long-term security and freedom.

It’s the same income, just moving smarter, working for you instead of the bank.

What Happens After You’re Debt-Free

Becoming debt-free isn’t the finish line, it’s the turning point. Once your cash flow is optimized and the banks stop collecting from your future, those same dollars can be redirected to strengthen your financial foundation and begin building long-term security.

That’s where your Debt to Wealth Process moves to its next stage, turning efficiency into opportunity. The same structure that helped you eliminate debt now becomes the framework for:

- Building long-term wealth

- Creating retirement income

- Accelerating financial freedom without earning a penny more

When your cash flow gains momentum, it doesn’t just eliminate debt — it creates the space for your money to start building long-term security.